Nvidia Hits Record $13.5 Billion Revenue on Explosive AI GPU Sales

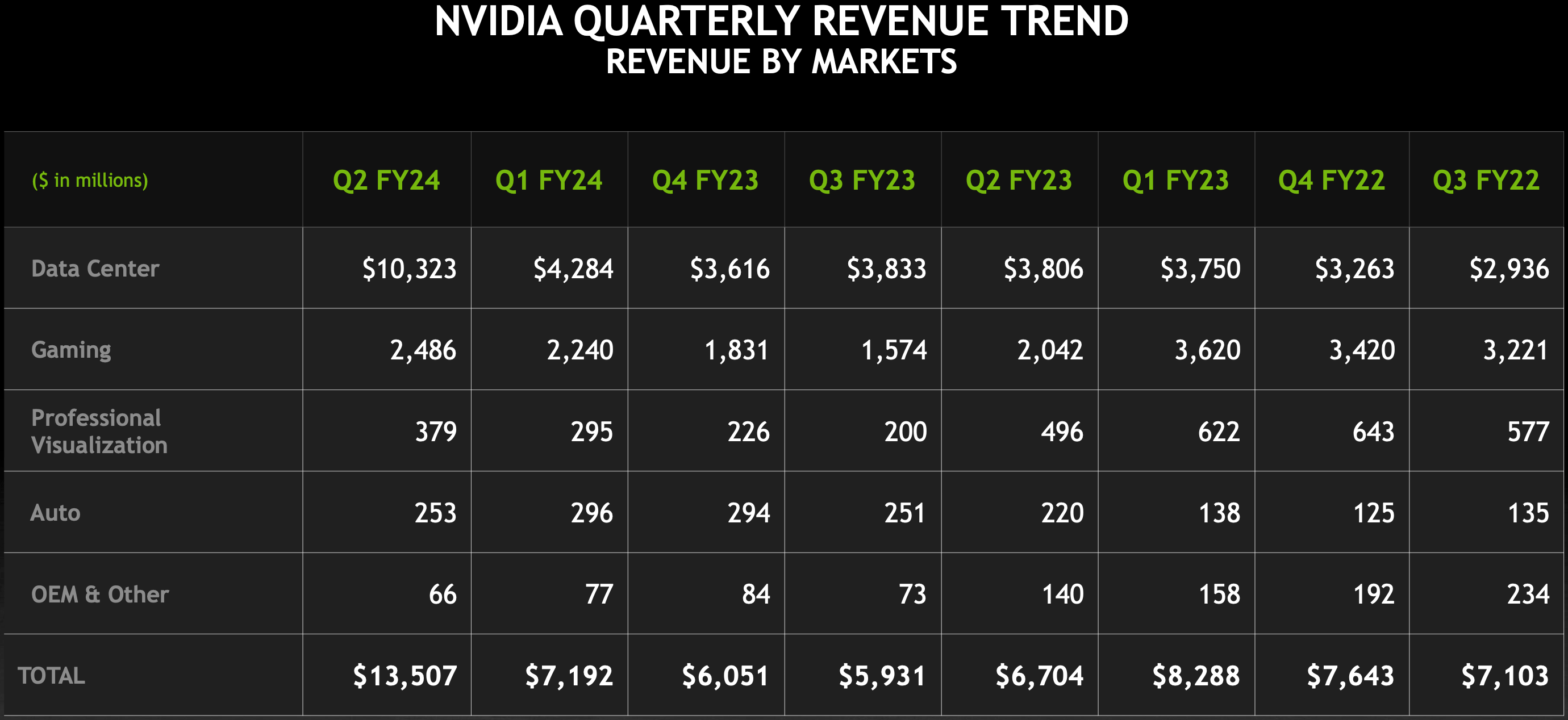

Nvidia this week posted its all-time-record revenue of $13.5 billion as sales of its gaming hardware exceeded expectations, while sales of its compute GPUs for data centers exceeded $10.3 billion — more than double the previous quarter — and demonstrated the roaring success of the company’s A100 and H100 processors for artificial intelligence (AI) and high-performance computing applications (HPC).

“A new computing era has begun,” said Jensen Huang, founder and CEO of Nvidia. “Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

Nvidia’s revenue in the second quarter of fiscal 2024 reached $13.51 billion, marking a 101% rise from the previous year and an 88% jump from the previous quarter. Gaming revenue grew by 22% year-over-year, driven by demand for the GeForce RTX 40-series GPUs after inventory stabilization and the launch of multiple new offerings, including GeForce RTX 4060 and GeForce RTX 4070 class cards.

But sales of datacenter GPUs in Q2 FY2024 was Nvidia’s major triumph. It hit $10.323 billion, growing 171% year-over-year, and exceeded the datacenter revenue of AMD and Intel combined. Nvidia’s datacenter revenue saw significant growth driven by demand from cloud service providers. Nvidia’s HGX platforms based on the Ampere and Hopper GPU architectures were particularly sought after, especially for the development of large language models and generative AI. Additionally, the expansion of InfiniBand infrastructure, which supports the HGX platform, and the strong performance of the Hopper-based compute GPUs for HPC, further boosted the revenue.

“During the quarter, major cloud service providers announced massive Nvidia H100 AI infrastructures,” said Huang. “Leading enterprise IT system and software providers announced partnerships to bring Nvidia AI to every industry. The race is on to adopt generative AI.”

Other Nvidia businesses also performed very well. Professional visualization (ProViz) revenue declined 24% year-over-year but rose 28% quarter-over-quarter, influenced by enterprise workstation demand and new Nvidia RTX products. Automotive revenue increased 15% annually, boosted by autonomous platform sales, but dropped 15% quarterly due to reduced auto demand, notably in China.

Over the past few months we have heard rumors that Nvidia’s compute GPUs are sold out for quarters to come. Given the ongoing generative AI craze and demand for appropriate hardware, we’re not surprised, but since the sources of the information were unofficial, we took the data with a grain of salt.

But Nvidia seems to be extremely optimistic about its future. The company expects its revenue in Q3 FY2024 to be $16 billion ± 2% and gross margins to be between 71.5% to 72.5%.